Join the future of unified commerce

We’re on a mission. Since 2005, we’ve strived to become one of the most innovative payment technology companies in the United States. Our platform revolutionizes payments technology by delivering payments and banking in one powerful place. Be an important part of it all by joining our fast-growing team.

Are you ready to

make a difference?

make a difference?

If you bring your passion and talent, we’ll ensure you have the tools and support to do your best work and make a real impact on our future, and your own. We believe in fostering unity, innovation and collaboration because, as a team, we can better serve our partners and keep moving forward.

Current Employee Testimonials

"During my time here, I have had the privilege of working on some truly innovative projects alongside some of the best and brightest minds in the industry. Our company, and the people who represent it, are committed to fostering a culture of creativity and collaboration which has been instrumental in my personal and professional growth. I'm proud to be part of this team, am grateful for the opportunities that I've been given, and am excited to see what the future holds - not just for me but for us - for Priority."

"When I began working for Priority, I was new to credit card processing and had never worked in the corporate setting. Priority did an amazing job of training and imparting the knowledge that has built my confidence in the services and products we provide. I have enjoyed working for Priority largely because of my peers and leadership. I was immediately welcomed into a family of caring people that have made coming to work a joy. I strive for excellence in my work, but Priority pushes and enables me to go the extra mile for our customers. I have been given the tools and time needed to grow in my job, so that at the end of the day I am satisfied with the work we do. My peers rely on each other daily and assist with providing the best customer service possible."

"I am truly grateful to be a part of the Priority family, where the values of diversity, and a family-oriented culture are not just words but ingrained in our work environment. The emphasis on being family-oriented creates a unique and supportive atmosphere, where colleagues genuinely care about each other's well-being."

"Working at Priority Technology Holdings has permitted me to be closely involved in meaningful contributions to the financial world. I am proud to be associated with a company that values innovation, teamwork, and the relentless pursuit of excellence. Being surrounded by talented professionals who are passionate about transforming the financial landscape motivates me to bring my A-game consistently."

"I am grateful to be a part of Priority, a company that truly values its employees. Working here has been a rewarding experience, thanks to the company's commitment to fostering a positive and supportive culture. Priority not only prioritizes the well-being of its employees but also invests in their professional development. I appreciate the opportunities for growth and the caring environment that sets Priority apart. Grateful to be part of a team that not only excels in its industry but also genuinely cares about the individuals contributing to its success."

Careers

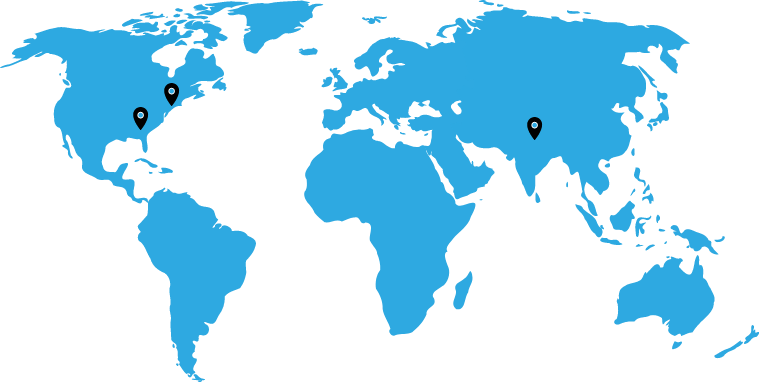

With offices in the United States and India, Priority offers worldwide opportunities.